Working in the transportation industry you have surely heard of comcheks. But just starting out it may be a bit confusing to figure out how a COMCHEK™ works and why companies use them. A COMCHEK is a form of payment most frequently used by freight brokers to pay contract carriers, and they work in a similar way to a regular check but with some differences.

Express Codes

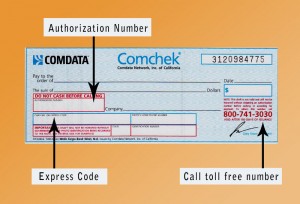

A payer (shipper or a broker) that has an account with COMDATA, issues COMCHEKs to drivers for services rendered or as a fuel advance and they do so in a form of an Express Code for a predetermined amount. The Express Codes vary in length, usually from 14 to 18 digits in length, but will always be just numbers not letters.

Once the payee (trucking company) receives their express codes they have several options to redeem their money. Comcheks can be cashed at truck stops or any bank as long as Comchek blank is present.

When depositing directly into the bank, the payee must call the toll free phone number provided by COMDATA to get authorization for that Express Code. The payee cannot cash the COMCHEK until he has called Comdata to get an authorization number, not doing so will cause the check to bounce and cause you to incur insufficient funds fees by your bank. Once COMCHEK blank is filled out it can be used a regular check and even cashed with no fees. Talk to your bank for additional assistance processing COMCHEKs.

COMCHEKs can be cashed at truck stops when buying fuel, however some locations will charge a processing fee if you are not buying any fuel there. Look into GoComchek for locations that accept COMCHEKs.

COMCHEK Phone Number: (800) 266-3282

COMDATA Cards

Trucking companies can also look into making their own accounts with COMDATA to issue COMCHEKs for their drivers. It provides a convenience and flexibility to monitor driver spending. With the COMDATA account a trucking company has the option to issue cards to their drivers that work similarly to an ATM.

Fees

When compared to credit cards, transaction fees for COMCHEKs are much lower. Depending on the account and volume, fees may be as low as $4 per $1000. COMDATA charges a flat fee for COMCHEKs and prices per $1000, meaning it costs the same to issue a $20 COMCHEK as it would for $1000. It is not uncommon for some brokers to mark up the cost of COMCHEKs, most common being $10/$1000 but in some cases as high as $40 for a single COMCHEK.

Pro’s and Con’s of COMCHEKs:

- Comcheks allow truck drivers freedom from carrying large amounts of cash on hand.

- Comcheks enable to get payment faster and improve cash flow while on the road.

- Comcheks usually have a processing fee. Fees increase with higher payment amounts.

- Drivers can get a Comdata account and can deposit their payments into that account as well.

Some of Your Questions About COMCHEKs:

Can you stop payment on a Comchek?

No! Once a comchek is cashed or is deposited to a bank with an authorization number the issuer cannot stop payment on it.

How do I get a comchek?

If you do not already have an account with Comdata – you can call their toll free number and speak with customer service. You can “purchase” a comchek with a credit card but fees will apply.

How long is a typical express code?

Express codes can vary in length, most are 14 or 18 digits long with no letters.

What does “P” or “L” Fees Mean When Creating a Code?

“P” – means you want the comchek fee added from the final amount

“L” – means you want the comchek fee subtracted from the final amount

$1000 comchek with “P” – means that $1004 will be deducted from the account holder – but $1000 will be given to the recipient. $1000 comchek with “L” means that $1000 will be deducted from the account holder – but $996 will be given to the recipient

How is COMCHEK different from a T-Chek?

T-Chek is a competing product to Comchek and is issued by EFS. They work in a similar manner as comcheks. Learn more about T-Cheks here.

So is it COMCHECK or COMCHEK?

These 2 terms are used interchangeably but Comdata corporation holds the trademark to COMCHEK since 1974. Per the US Patent and Trademark Office, COMCHEK is for “ISSUING CHECKS AND AUTHENTICATING THE CASHING OF SUCH CHECKS BY TELEPHONE CONFIRMATION TO PARTICIPATING PARTIES “